Impact of Wealth Inequality on Farmland Acquisition

AGRICULTURAL MARKETS

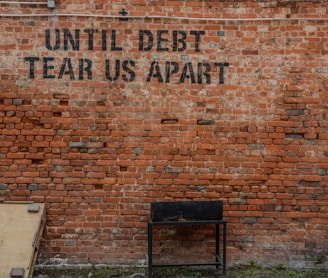

The growing wealth inequality and the devaluation of money are significantly impacting farming businesses, especially for young farmers who are finding it increasingly difficult to purchase land and assets. As older farmers sell their land to private equity firms and large farming corporations rather than the next generation, the agricultural landscape is rapidly changing. This shift threatens the sustainability of farming communities, reduces crop diversity, and poses risks to food security. Explore how these economic trends are reshaping the future of agriculture and the urgent need for equitable land access and sustainable practices.

How Wealth Inequality Affects Farming Businesses: Challenges in Purchasing Land and Assets

The agricultural sector has always been integral to the economy for its role in food production and as a significant source of employment and community identity. However, the increasing wealth inequality in the broader economy puts immense pressure on farming businesses, particularly young farmers trying to purchase land and assets. As older farmers retire and opt to sell to private equity firms and large farming corporations instead of the next generation of farmers, the landscape of farm ownership and agricultural productivity faces a profound shift. This article explores how these economic trends are affecting farming businesses, with a particular focus on land and asset acquisition.

Understanding the Devaluation of Money

To understand the challenges young farmers face today, it's crucial to grasp the concept of the devaluation of money. The devaluation of money refers to the decrease in purchasing power over time. This phenomenon is closely linked to inflation, where the prices of goods and services rise, requiring more currency to buy the same amount of a commodity or asset. For further reading on how this process impacts everyday consumers and businesses, you can watch this video on the devaluation of currency.

Think of money as an ice cube on a hot day. At first, it seems solid and holds its shape, but as time passes, it slowly melts, losing its form and volume. Similarly, the value of money gradually decreases over time, especially when inflation is high. In this scenario, the value of money "melts away," making it harder for people, including farmers, to save and invest in new land and equipment.

A real-world example that illustrates this devaluation is the rise in house prices. House prices have increased by seven times over recent decades, while wages have not kept pace. This is not because houses have fundamentally become more valuable, but because the purchasing power of money has decreased. Imagine if farmers in the past could buy land for the equivalent of their annual savings. Today, due to inflation and the devaluation of currency, the same land might cost ten times their savings, making it nearly impossible for young farmers to afford it.

The Asset Economy: A Shift in Wealth

Alongside the devaluation of money, we have seen the rise of what economists call the asset economy. In an asset economy, wealth is increasingly tied to owning assets—such as land, stocks, or real estate—rather than earning a steady income from labor. Over the past few decades, asset prices have soared, while wages for most people have remained relatively stagnant. For a deeper dive into this shift and its implications, check out this explainer on the asset economy.

An analogy to help understand the asset economy is comparing rising house prices to falling wages. If wages were to drop significantly, public outcry and calls of economic collapse would occur. However, when house prices rise by the same magnitude, it is often perceived as a sign of a strong economy. This perception is misleading. Rising asset prices (like land and houses) relative to wages mean that it costs much more to acquire these assets today than it did in the past. For young farmers, this means needing significantly more capital to buy land than previous generations, effectively locking them out of the market unless they have substantial financial backing or inheritance.

Another example is the synchronized devaluation of multiple currencies after the COVID-19 pandemic, where the value of the pound, euro, and dollar all fell at the same time. When multiple currencies devalue together, it isn't always visible in the foreign exchange markets because their relative values remain stable. Instead, the devaluation manifests in rising prices of goods and services across the board. For young farmers, this means higher costs for everything from land to equipment, further exacerbating the challenges of entering the farming business.

The Impact on Young Farmers: Barriers to Entry

Rising Land Prices:

For young farmers, the dream of owning land is becoming increasingly unattainable. As land prices rise due to asset inflation, new entrants find themselves priced out of the market. Unlike older generations who may have inherited land or purchased it when prices were lower, young farmers today face an economic environment where the cost of land far exceeds what they can afford through savings or loans. This is especially problematic as land is not just an asset but a critical resource for farming, directly impacting a farm's potential to generate income.

Difficulty Accessing Credit:

The high cost of land also makes it difficult for young farmers to secure loans. Banks and financial institutions are less likely to lend to young farmers who do not have significant collateral or a proven track record. As a result, young farmers often find themselves in a catch-22 situation: they need land to farm and generate income but cannot afford the land without income or significant financial backing.

Competitive Disadvantage:

Wealth inequality means that a small percentage of the population holds a disproportionate amount of wealth. These individuals and private equity firms can outbid young farmers for land purchases. Older farmers nearing retirement often prefer to sell to the highest bidder, which is usually a private equity firm or a large farming corporation rather than a young farmer with limited capital. This trend reduces the opportunities for young farmers to enter the market and grow their operations.

The Role of Large Farming Corporations in Land Consolidation

Corporate Land Grabs:

Large farming corporations have increasingly taken over significant portions of farmland, driven by their ability to leverage economies of scale. This process, often called "land consolidation," involves acquiring smaller farms and merging them into larger agricultural operations. For small and young farmers, this consolidation represents another entry barrier, making it even harder to compete against these well-financed giants.

Impact on Crop Diversity and Sustainability:

As large farming corporations prioritize profit and efficiency, they often focus on monoculture farming—growing a single crop over a large area. While this method can be more profitable in the short term, it reduces crop diversity, making the agricultural system more vulnerable to pests, diseases, and climate change. This shift means less variety and potentially higher prices for diverse foods for consumers.

Erosion of Local Economies and Knowledge:

When large corporations take over farms, they often employ fewer workers than the small farms they replace. This shift can devastate local economies, leading to job losses and a decline in community cohesion. Furthermore, the traditional knowledge and sustainable practices of local farmers are often lost, replaced by industrial farming methods that may not be as environmentally friendly or suited to local conditions.

The Impact on Older Farmers: Selling to Private Equity and Corporations

Financial Incentives to Sell to Corporations and Equity Firms:

For older farmers looking to retire, the financial incentives to sell their land to private equity firms and large farming corporations are often too attractive to pass up. These entities offer higher prices than what young farmers can afford, making it an easy decision for older farmers who want to maximize their retirement funds. However, this trend has long-term consequences for the agricultural community and the sustainability of farming practices.

Loss of Generational Knowledge and Community Identity:

When farmland is sold to private equity and corporations rather than passed down to younger farmers, there is a loss of generational knowledge and community continuity. Farming is not just a business; it is a way of life that requires extensive knowledge passed down through generations. This knowledge includes understanding local ecosystems, weather patterns, and sustainable farming practices that are critical for long-term agricultural success.

Shift Towards Industrialized Agriculture:

Private equity firms and large corporations often view farmland primarily as an investment rather than a long-term community resource. This shift in ownership can lead to changes in how land is used, moving towards more industrialized agricultural practices that may prioritize short-term profits over sustainability. This can result in environmental degradation, a loss of biodiversity, and the erosion of soil health, which further affects the viability of farming for future generations.

Long-Term Implications for the Agricultural Sector

Reduced Agricultural Resilience:

As private equity firms and large farming corporations take over more farmland, the agricultural sector becomes less resilient. These entities are less likely to engage in diversified farming practices that protect against crop failures or market fluctuations. Instead, they may focus on monoculture crops or intensive farming practices that can be more profitable in the short term but risky in the long term.

Barriers to Innovation and Adaptation:

Young farmers are often more innovative and open to adopting new farming technologies and sustainable practices. However, when they are excluded from the market, the agricultural sector loses these potential advancements. Innovation is crucial for adapting to challenges such as climate change, pests, and diseases, which are increasingly becoming more severe.

Economic and Social Inequities:

The concentration of land ownership among private equity firms, large corporations, and wealthy individuals exacerbates existing economic and social inequities. Rural communities suffer as local farmers are pushed out, and their socio-economic fabric frays. This dynamic can lead to increased poverty, reduced access to services, and a decline in the overall quality of life in rural areas.

The Impact on Food Security and Consumer Choice

Threats to Food Security:

As large corporations and private equity firms prioritize profit over diversity and sustainability, there is a risk that the agricultural system becomes less capable of meeting diverse nutritional needs. A focus on a few highly profitable crops can make the food supply chain more vulnerable to disruptions, whether from climate change, pests, or economic shifts. This vulnerability could lead to shortages and higher prices, affecting consumers worldwide.

Loss of Local and Organic Foods:

Consolidation in the farming industry often means that small, local, and organic farms struggle to survive. These farms are more likely to produce diverse and niche products that cater to specific consumer preferences. As these farms disappear, consumers lose access to locally grown, organic options, reducing choice and potentially impacting health and dietary diversity.

The shift in wealth inequality and the resulting economic dynamics have profound implications for farming businesses, particularly when it comes to purchasing land and assets. The devaluation of money and inflation of asset prices make it increasingly difficult for young farmers to enter the market, while older farmers are incentivized to sell to private equity firms and large farming corporations rather than the next generation of farmers. This trend threatens the sustainability and resilience of the agricultural sector, leading to a loss of generational knowledge, reduced innovation, and increased social and economic inequities in rural communities. Moreover, the consolidation of farmland by large corporations can reduce crop diversity, threatening food security and limiting consumer choices.

To address these challenges, policymakers and agricultural stakeholders must consider measures that promote equitable land access, support young farmers, and encourage sustainable farming practices. Without these changes, the agricultural landscape will continue to shift away from family-owned farms toward corporate-controlled entities, with significant consequences for food security, environmental sustainability, and community well-being.